Asset management

Like many foundations, the Foundation for Baltic and East European Studies takes a permanent stance on its assets. The original endowment has to be managed so that it at least retains its real value over time. The assets must also be managed in a secure manner, limiting the risks and making best use of the potential for a good return. The Foundation’s Board has adopted an investment policy that serves as a set of guidelines for its asset management, and is revised annually.

The Board has adopted a requirement of an average real annual return. The current figure is 4.5 per cent. Every year, the Foundation’s Board also adopts a ’normal portfolio’, which specifies allocation among asset classes and permitted deviations from the same.

The following principles are guidelines for asset management. The Foundation for Baltic and East European Studies:

- Strives to spread risk through well-diversified portfolios in the asset categories selected.

- Endeavours to achieve a low turnover in the portfolios and low management costs, since turnover and costs exert a significant effect on management outcome in the long term.

- Works independently in managing its assets, and takes its own investment decisions.

- Continuously examines its share investments from ethical and environmental points of view.

The Board bears ultimate responsibility for the Foundation’s asset management. On the Board’s behalf, asset management is carried out by an investment committee. This committee meets monthly. The Foundation employs managers to deal with the assets on a continuous basis. The Swedish Legal, Financial and Administrative Services Agency performs the Foundation’s back office and middle office functions. Alongside the regular audit, the asset management is examined by an external party (a form of ‘internal control’).

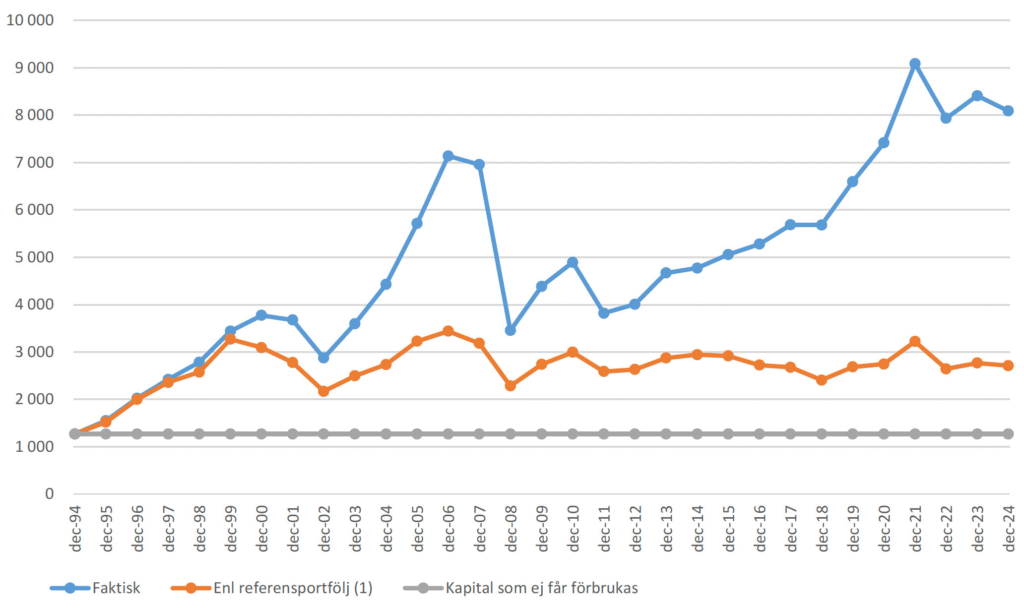

When the Foundation was formed in 1994, its endowment was SEK 1,270 million. The average annual return from the formation until 31 December 2024 was 9.6 per cent (real return 7.8 per cent). During this period, SEK 4,9 million was distributed in grants.

The following diagram shows, in blue, the Foundation’s actual trend of asset value from the formation in 1994 to 31 December 2024. The orange line represents a reference portfolio in which 40% is composed of bonds and 60% of shares, while the gray line shows the assets that are not permitted to be depleted.